PLEASE NOTE – Applications for Help to Buy were to be submitted by 31st October 2022, and is no longer available to new applicants.

The Mortgage Mum takes a look at how the new Help to Buy scheme can benefit First Time Buyers, how you can apply, and what you need to know. Read on, or listen to our new episode from The Mortgage Mum podcast is out now on all major podcast directories including Apple and Spotify.

What is the new Help to Buy scheme and who is it for?

This is for you if you are a first time buyer and you want to take advantage of a scheme that’s going to give you part of your deposit interest-free, for the first five years of owning a property. It’s only for newly built homes, therefore, you do need to love new build properties!

If you are a First Time Buyer in England, you can apply for the new Help to Buy scheme. It’s called a ‘Help to Buy Equity Loan’, and it’s running from now until 2023. This is a loan from the government that you put towards the cost of buying a new build home.

How much can I borrow?

You can borrow a minimum of 5% up to a maximum of 20%, or 40% if you’re living in London, of the full purchase price of a new build home, interest-free for five years. You do have to make sure you’re buying this house or home from a home builder that’s registered for the Help to Buy equity loan.

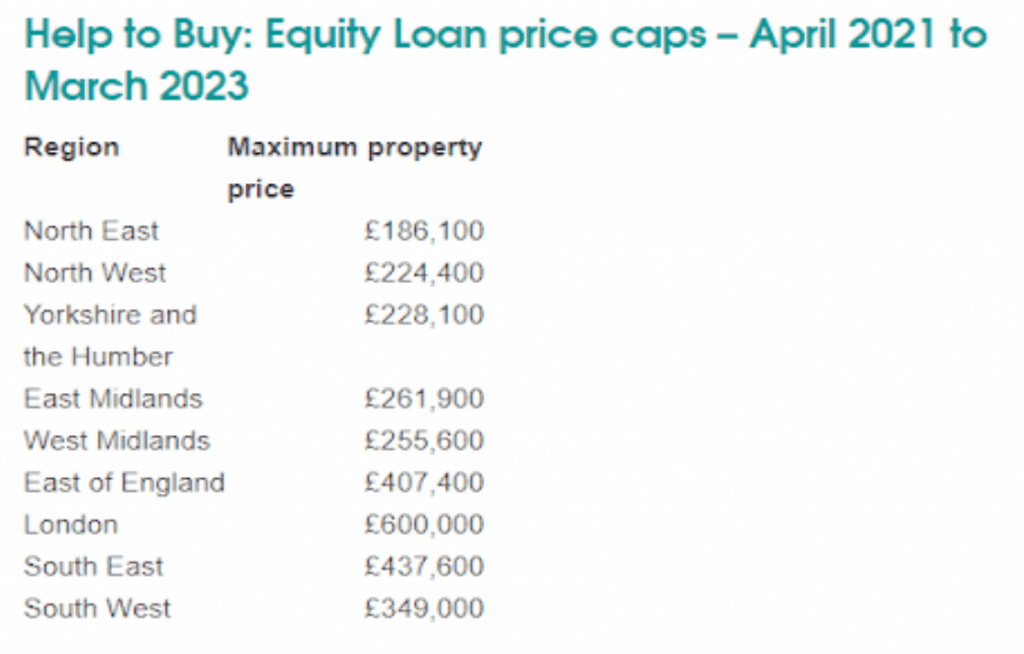

The amount that you pay depends on where in England you buy it. There are now different maximum property prices for all of England. Beforehand, it used to be £600,000 and it was available to first-time buyers and homeowners. It now depends on where you live.

Property prices for each region vary from the North East at £180,100, the South East at £437,600, all the way up to London at £600,000. That is the maximum property price, which may limit some of you.

Generally, builders are aware of this happening and they are going to have to factor that in if any new plots are being built. The percentage you borrow is based on the market value of the home when you buy it. The way it works is you take it out and it adds to your deposit.

If you’ve got a deposit of 5% saved and you’re thinking, “ I can’t get on the property ladder, there’s no 95% mortgages anymore,” then this might be your solution.

What does this mean?

This means you can put 5% in and the government will top that up with the other 20%, and you’ll have a deposit of 25%.

What we do with our clients is we talk about the next five years. For example, we might ask the following questions:

- “What does your career look like?”

- “What’s going to happen to you in the next five years?”

- “How can we work with you to get you focused on paying off this Help to Buy loan in that five years while it’s interest-free?“

The ideal solution is that during your remortgage or within those five years that we can pay them back and then you have used it in the best way. You don’t pay any interest on this equity loan for the first five years. You start to pay interest in year six on the amount that you’ve borrowed.

The equity loan payments are interest-only therefore you don’t ever reduce that balance. When you sell the property or when you do come to pay it back, whatever the value of the property is, whatever percentage you borrowed, it’s the percentage of the value then.

For example, if you’ve got a property that you bought for £200,000, then you used a 20% equity loan to buy it, ou’ve then got £40,000 from the government and you put in 5% as an additional deposit.

This means you found £10,000 to put a deposit down and then the mortgage makes up the rest. This is 75% of the value of the property and that is £150,000. If that property goes up by the time you repay it, all of that changes, and you pay back 20% of whatever the property is valued at then.

How do I know if this is right for me?

When you’re considering whether this is right for you, you need to think short-term and also long-term. To make you aware, you will pay a £1 monthly management fee by direct debit. That’s normal, that’s meant to happen.

Otherwise, the equity loans are interest-free for the first five years. From year six, you’re still going to pay that £1 monthly management fee, but you’re also going to pay a monthly interest rate of 1.75% of the equity loan.

You’re also going to pay a monthly interest rate of 1.75% of the equity loan. That interest rate will rise every year in April by whatever the consumer price index is, plus 2%. You’ll continue to pay interest until it’s repaid in full. Therefore, you agree that you are going to pay back this loan in full plus interest in management fees.

That’s important but you can pay it in full at various points. You can do this at the end of the equity loan term. You can do this when you pay off your mortgage, when you sell the property, and you can do this when you do a remortgage and potentially buy them out.

There are lots of different times and ways that you can do this. You may even come into some money and be able to pay it off that way. All in all, the amount you pay back is worked out as a percentage at the time you choose to repay it. If the property price rises then so will your loan. If it falls then the amount falls too.

Speak to an expert

We will work at times that suit you and your family, carrying out appointments via video call, telephone or email, giving you the benefit of first class service, around your own schedule, and in the comfort of your own home. So let us handle your mortgage today and find out how well we can look after you, The Mortgage Mum way!

Help To Buy Scheme – Then VS. Now

As previously stated, this was eligible for homeowners. Now, it’s just for First Time Buyers, and the new build home must be within the relevant regional price cap. Please see below:

Table of figures taken from www.helptobuy.gov.uk

You or the person you’re buying the home with, must not own a home or residential land now or in the past in the UK or abroad. We are Help to Buy agents and we can check if you’re eligible for the scheme.

We have an eligibility calculator tool and we check your monthly income and outgoings, but we’ll also check affordability. Affordability with our mortgage lenders is different to Help to Buy. Therefore, you do have to make sure your mortgage broker is a Help to Buy agent.

Don’t let the new build housing schemes make you feel like you have to use their broker. They can be very tactical but you can use any help to buy agent. It doesn’t have to be linked to the new build site. This is always worth a mention because it happens all the time.

As First Time Buyers, you’re fearful. You want the property, you don’t want to lose it and you’ll do whatever it takes. Just remember, you’re in safe hands with Help to Buy agents that are outside of that as well.

What are the legal requirements?

You will need to sign a legal declaration to confirm that you’re a First Time Buyer and your conveyancer will explain all this to you. Again, make sure you’ve got a good solicitor. You need to be able to trust your solicitor. This is so important, especially when you’re dealing with something like Help To Buy where it’s not necessarily straightforward.

Before you get started looking at new builds, searching on Rightmove, and attending viewings (which you can still do in a pandemic!) you need to make sure you’ve got the money to pay for a fee to reserve your home, which is up to £500.

You need to have a 5% deposit by exchange. This means when you exchange your contracts, you’ll need a 5% deposit on exchange. You can put down more than a 5% deposit, that’s fine, and that helps with affordability as well. You can still do Help to Buy and put a bigger deposit down than the 5%.

You’re going to need to have funds to pay for any other fees on completion. For example, stamp duty, (although you get stamp duty relief at the moment and the stamp duty holiday), legal fees, and mortgage fees. You need to make sure that you understand your financial situation.

That’s why we want to make sure we explain all of that to you so that you understand everything before you’re applying for it. It’s not a discount. It’s not a price reduction. The purchase price is the same, whether you’re buying it with Help to Buy or not.

Make sure you love the home you’ve chosen!

To clarify, it’s not a discounted price, don’t have that sales mentality. Make sure you still love that home just as much as if you were buying it without the Help to Buy scheme. It’s really important because it’s amazing how quickly that if you don’t love a home, things become very irritating once you’re there. Make sure you get that right feeling.

You’ll know when you have the feeling when you walk through the door and you start to imagine yourself living there. It’s unexplainable but you will get a gut feeling. When people lose their houses, you know that one day they are going to turn around and say, “Gosh, I’m so glad that happened because this happened, and now I’ve got this amazing place.”

Trust the process. Buying a property is one of the most personal things you will ever do. It’s a beautiful, stressful, all-consuming process. Make sure you’ve got some support around you but enjoy it.

You’re buying your first home and especially if it’s a new build, everything’s brand new. You also get to pick some things as they’re being made. It’s so exciting!

The all-important details and recap:

If you were a Home Mover looking to use the Help To Buy scheme, you will have had to complete this by now.

This is now only for First Time Buyers. If you would like to find out who your local Help To Buy agent is, please visit: www.helptobuy.gov.uk/equity-loan/find-helptobuy-agent. This will show you a map of England, and you can pick where you’re looking. From here this will show you some Help to Buy agents in that specific area.

We are also a Help to Buy agent, and we can put your mortgages through for you and take care of the Help to Buy Equity Loan. These are two separate applications, and it’s a very particular process. You just need to know that it’s being taken care of and handled.

There are a few more steps in the process with Help to Buy than there are with a normal mortgage. We need to have the companies working side by side. There are lenders out there who do Help to Buy too, so you have lots of choices. It’s our job to make sure we get you the most suitable lender we can.

As a general warning, there has been a number of occasions where a lender will lend more money to the customer than the Help to Buy will. They’ve then come unstuck because they’ve spoken to a broker who isn’t a Help to Buy agent, and they’ve been told they can borrow X amount of pounds with a mortgage lender, when in fact the Help to Buy scheme provider will not allow them to. Don’t be one of those people. Make sure you speak to a broker that also specialises in Help to Buy before you fall in love with a property. This way, you’re looking at properties within your budget and your price range.

If you have any questions or you would like to look into this yourself, please do get in touch with one of us. We’d love to continue helping people get on the property ladder, get the home of their dreams, and also pay it off within those five years if possible.

Sarah Tucker, Director, The Mortgage Mum