Welcome to

The Mortgage Mum

Specialist Finance

Your Expert in Specialist Finance.

Get in touch today to discuss the best finance options for you.

Get in Touch

About our Specialist Lending team

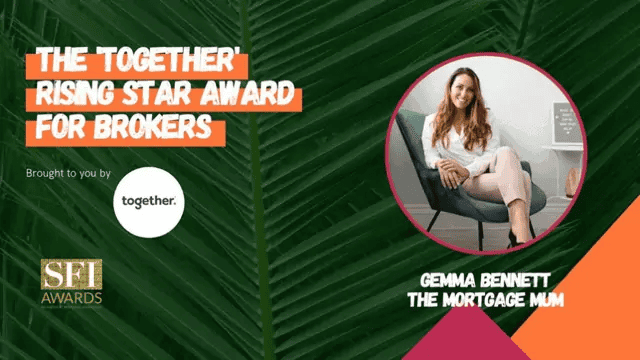

The Mortgage Mum specialist finance has been established to bring our core values from The Mortgage Mum to another sector within the mortgage and financial services industry. As an all-female brokerage, we pride ourselves on adding that extra care, attention and compassion sometimes lacking within this sector – “The Mortgage Mum way!”

In a short space of time The Mortgage Mum has taken the mortgage industry by storm, becoming a national household name, regularly appearing in the press, winning multiple industry awards and breaking the mould. We intend to replicate this success with our Specialist Finance offer to help aspirational investors and seasoned entrepreneurs alike.

Our aim is to bring the reputation of the brand as a trusted five-star service which is tenacious and outcome focused, to our clients. We’re committed to ensuring you are fully informed and understand all the benefits and risks in your undertakings while we go the extra mile to offer support in what are often time sensitive and stressful financial transactions.

Whilst linked to The Mortgage Mum, The Mortgage Mum Specialist Finance is a separate ‘sister’ company working under the New Leaf Network allowing us to bring a wider range of finance products to our clients, with excellent rates, decades of experience in commercial lending and a solid history of success.

What is Specialist Lending?

Specialist lending includes a range of finance options that sit outside of the traditional mortgage market. Specialist lenders often have a more flexible approach to lending, with manual underwriting and rates being based on the whole circumstances of the person or business applying. This will include finance for:

- Commercial or semi commercial property – for office or business use, for buy to let or for you as a business owner, with or without a residential element

- Uninhabitable property e.g. following after a fire or flood, or without a roof, kitchen, bathroom etc.

- Property requiring significant refurbishment or reconfiguration e.g. standard property into HMO

- Auction purchases needing funds swiftly

- Land with or without planning permission for development

- Individual new builds and large scale developments

- Second charge loans (secured loans) on residential, commercial or investment property

- Property investors and portfolio landlords – living in the UK or overseas

Other specialist finance products which we can access through our established network of referral partners include:

- Private banking for high net worth clients

- Business & personal protection

Types of Specialist Lending

- Bridging – regulated and unregulated

- Development finance

- Commercial/semi commercial Loans

- Secured loans

- Business loans – invoice and cashflow finance

- Asset finance

- Complex buy to let and portfolio loans

Why use The Mortgage Mum for Specialist Lending?

Quite simply because we want to work with you to bring you the best products on the market to help you to achieve your ultimate business and property goals! Our clients have been asking us for a range of options beyond standard mortgages, and we have listened! We are so passionate to now bring you The Mortgage Mum Specialist Finance.

Many brokerages will arrange specialist lending via third parties which can lead to a less personalised service and delays in processing applications. Here at The Mortgage Mum Specialist Finance we will get to know you personally, fully understand your needs and support you through the whole application until funds are released.

We like to develop long term relationships with our clients to support you for years to come, without you having to keep repeating the same information, saving you time and energy to enjoy the things you love!

Here's how we can help you